eCigarette and Vape Merchant Account

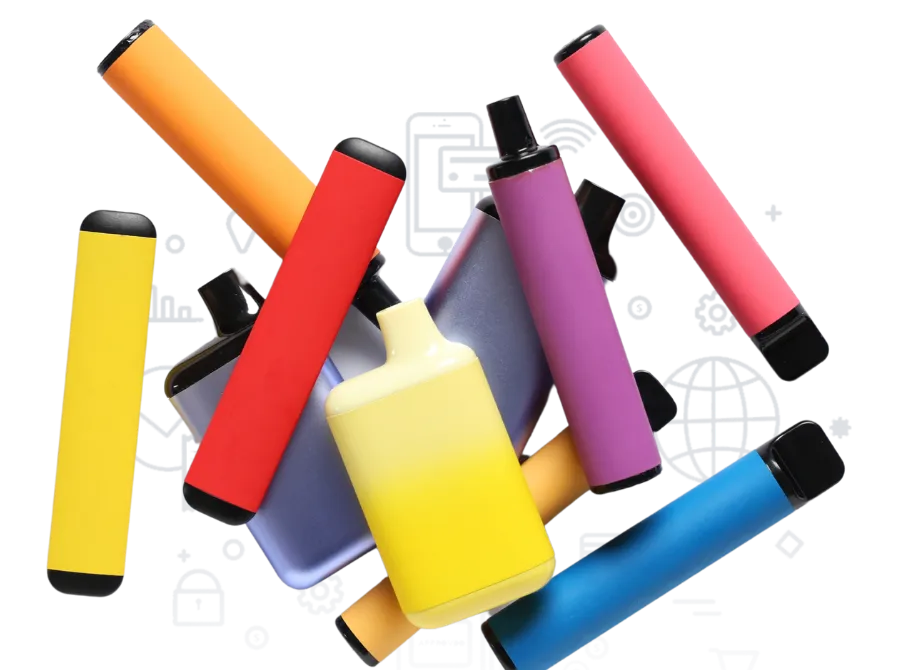

Comprehensive merchant account services for e-cigarette and vape shops

SUPPORTING HIGH-RISK MERCHANTS

Payment Solutions for eCigarette and Vape Shops

Many things make merchants high-risk. The main one is the nature of their business. Some high-risk merchants offer moneymaking products or services. Others offer adult entertainment or online gambling. Still, others are travel agencies or pharmaceutical companies. Some are e-cigarette and vape shops. All these products and services are legal, but they do come with risks.

GET STARTED TODAY

Why choose High

Risk Pay as your merchant

services provider ?

SPECIALIZED IN HIGH RISK

We offer high risk merchant accounts to all business types in high risk categories.

99% APPROVAL

We offer high risk merchant accounts to all business types in high risk categories.

FAST APPROVAL GUARANTEED

We offer high risk merchant accounts to all business types in high risk categories.

GET STARTED TODAY

Benefits of a High-Risk Merchant Account

High-risk merchant accounts do have some perks. Chargebacks are easier to handle, for example. After all, the account has already been vetted to reduce them. Also, most high-risk merchant account providers need a reserve fund to cover chargebacks. What’s more, high-risk merchant accounts use strict detection techniques during transaction processing to see whether a card is valid.

Don’t be content with having a physical store for your company. You can also set up a website for online sales. This places your products directly in the global marketplace. Doing so makes your stock accessible to a huge market. Credit card processing e-commerce are becoming an ever more widespread method of payment, especially online. Accordingly, business owners need to be able to process credit cards.

Advantages of Accepting Credit Card Payments

The ability to accept credit cards can increase a vendor’s sales. This, in turn, helps boost its profits. Customers can feel secure knowing that their card information is safe. In general, a buyer will trust a business that accepts credit cards. The ability to do so shows stability and respectability. However, high-risk businesses will have to rely on a high-risk merchant account to process their credit card payments.

Reasons Why E-Cigarette Businesses Are High-Risk

E-cigarette companies face high levels of risk. This is mainly due to their lack of regulation. Fear of future sanctions makes banks wary of this type of venture. Of course, you must choose vendors and employees when you go into business. But you must also pick a credit card processor. E-cigarette providers must seek these services from a high-risk merchant account specialist. Be sure to choose a company that offers simple solutions. But also make sure that your preferred vendor is reliable and secure.

Knowing Your Payment Processor

For high-risk accounts, the fees charged by payment processors are usually greater. What’s more, reserve merchant accounts can be required. Worse, chargeback fees can be higher than those for regular merchant accounts. However, a merchant that has a high-risk merchant account can reach a wider customer base. It can accept credit cards, offer recurring payments, and process large card transactions. When choosing a payment processor, bear in mind that “free” sometimes does not cover all charges. So if a provider is offering free payment terminals, check for hidden fees. You can avoid them by using an experienced and reputable payment processing company.

High Risk Pay’s Merchant Accounts

High Risk Pay has a variety of solutions for high-risk merchant accounts. These can help you take various methods of payment. You can offer the ability to swipe a card at a physical location, process phone orders using a card that is not present for the sale, or accepts payments through your website’s secure payment portal. High Risk Pay will work with your company. Together, you can make payment processing smooth for both you and your clients.

Avoiding the Effects of Chargebacks

Be careful not to have a high volume of chargebacks. That could cause your business to be deemed a high-risk merchant account. Sometimes, though, you can’t avoid them. Chargebacks occur when customers refuse to accept a charge on their credit card. A credit card–issuing bank may also initiate a chargeback. Sometimes this is because of a technical issue, such as the absence of an authorization code.

Every business owner should avoid chargebacks, which can lead to lost revenue. They can even mean the loss of the merchant account itself. Avoid chargebacks by following best practices at the point of sale. Also, adequately train employees in proper credit card processing methods. Follow payment processor protocol for accepting credit cards. Use an explicit payment descriptor. Get the customer’s authorization in writing. Keep good records. Fight back against chargebacks when doing so makes sense. Deal with customer service issues quickly. This last is crucial if you get early chargeback notices.

High Risk Pay’s Chargeback Prevention Program

High Risk Pay offers a chargeback prevention program. This can alert you to impending chargebacks. When you get an alert, contact the buyer to resolve the issue. Provide a full refund if you need to — the benefits of doing so last for the long term.

Preventing Fraud

High Risk Pay can also help you reduce fraud. It does this by identifying fraud-prone accounts. With this information, you can stop fraud early. What’s more, you can contribute to lessening the risk of credit card fraud yourself by educating employees about fraud. Train workers to compare signatures. Also, they should ask for ID when customers swipe their card. Watch out for buyers who try to distract you. In particular, be careful when a buyer is chatty or angry for no clear reason. Think twice before manually entering information from damaged cards. Also, swipe every card — if a card cannot be read, ask for another form of payment.

How to apply for a E-cigarette Merchant Account With High Risk Pay?

A High Risk Pay merchant account requires a few documents. Among them are a valid photo ID, a business license, and a current bank account statement. You’ll also need previous merchant account statements if you have them. A U.S. business banking account is also required; credit card payments are directly deposited into this account. There are no setup fees to open a new account. Even better, you can open one online.

Approvals take from 24 to 48 hours after you apply. You can start processing credit card transactions as soon as you are approved. You’ll recall that the funds credited to a regular merchant account are usually available within two business days. However, remember that high-risk merchant accounts may have longer wait times.

High Risk Pay provides merchant accounts for relatively risky businesses, so it has all the solutions that your e-cigarette business needs. You can enjoy reduced chargebacks with a high-risk merchant account, but that’s not all. You should also expect less fraudulent activity as well as access to a broad customer base. Do quick approval, the ability to open the account online, and the absence of setup fees sound perfect? They’re all part of the package with High Risk Pay. Contact highriskpay.com to find out how you can set up an account today.

What are you waiting for? APPLY NOW!

Sign Up Now

No Setup Fees!

Privacy Information: Your contact information will not be used for anything except contacting you regarding the question or comment you have.